Brazilians Drinking More and Better, the Wine Market Grows 41% in Volume Over a Decade

Wine consumption in Brazil continues on an upward trajectory. Between 2014 and 2024, the adult population increased by 12%, while per capita wine consumption rose by 26%. The total volume of wines and sparkling wines sold in the country grew from 322.6 million liters to 455.8 million – a 41% increase in ten years, according to data from Ideal B.i.

In 2024, the Brazilian wine market – including domestic and imported products – generated BRL 19.3 billion, equivalent to 0.2% of GDP, with 607.7 million bottles sold. Imported wines accounted for the largest share, representing 56% of total volume and BRL 10.9 billion in sales value. They were followed by Brazilian non-vitis wines (29%), Brazilian sparkling wines (8%), domestic vitis wines (4%), and imported sparkling wines (3%). Consumption is concentrated among individuals aged 35 to 55, who make up 59% of wine buyers in Brazil.

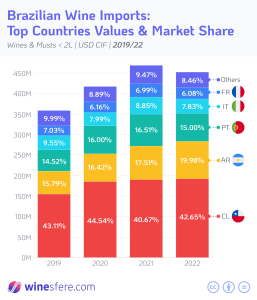

According to Ideal B.i, Chile maintained its lead among exporting countries to Brazil, with a 16% increase in volume between 2023 and 2024, followed by Portugal and Argentina, both growing around 10%. The total imported volume in 2024 reached 17.7 million 9-liter cases – a cumulative increase of 97.7% since 2014 – and FOB value surpassed USD 500 million, representing 60% growth over the period.

The imported wine market shows evidence of margin compression across the supply chain: the average import cost rose 51% between 2018 and 2024, while prices in Brazilian reais increased by only 15%. The average cost per 9-liter case reached BRL 157.9, and the average retail price hit BRL 55.3.

For 2025, projections point to a 3% to 5% increase in the total volume of imported wines. The first half of the year usually accounts for 43% of annual imports, and preliminary results confirm this growth trend. The country recorded a historic high of USD 239.2 million in imports during the period – 5.7% higher than in 2024 – driven by an increase in average prices.

Imports remain concentrated in wines priced up to USD 24.99 per 9-liter case, representing 63% of total volume, although this segment is showing a slight decline. Higher-value segments, however, are on the rise: +14.1% for wines priced between USD 25 and 49.99; +10.6% between USD 50 and 99.99; and +7.3% for wines above USD 100.

The number of active importers has remained stable. In 2024, there were 691 distributors and 623 supermarket chains dealing with imported wines in Brazil. The main countries of origin for these importers were Chile (305), Portugal (271), and Argentina (260), according to Ideal B.i.

Interest rates are among the main factors influencing import dynamics. When rates are high, the cost of financing and the dollar exchange rate make imports more expensive, squeezing margins and reducing large retailers’ appetite for direct imports. In this context, supermarkets – which account for a significant share of import volumes – tend to reduce direct imports and instead purchase wines from local distributors, who absorb exchange rate risks and maintain domestic inventory. This shift in strategy reduces the diversity of international labels while helping retailers maintain cash flow control. Conversely, during periods of lower interest rates, the scenario reverses: credit becomes more accessible, exchange rates stabilize, and supermarkets resume direct imports, negotiating larger volumes and more competitive prices. The market for Brazilian and imported sparkling wines posted remarkable performance in the first half of 2025. More than just a record, the results indicate that consumption is becoming less seasonal and increasingly part of consumers’ daily lives. Traditionally, the first half of the year accounts for 25% of annual consumption, and forecasts point to 10%–14% volume growth for the full year.

Among product categories, Moscatel sparkling wines achieved double-digit growth over the past decade, but other varieties – such as Brut, Extra Brut, and Nature – have been growing at an even faster pace. The most recent highlight is non-alcoholic sparkling wine, which saw an 88.7% increase in volume, reinforcing the trend toward low- and zero-alcohol beverages in the Brazilian market.

Data from : Ideal B.i.

Please read : ProWine São Paulo exceeds expectations and confirms expansion for 2026

This article was published on October 15th, 2025.